ERPNext Digital Signature Integration

Digitally sign Sales Orders, Sales Invoices, Purchase Orders and Purchase Invoices using a visible PFX certificate signature.

⚠ Problem Statement

In many ERPNext implementations, signing documents like Sales Orders, Sales Invoices, Purchase Orders and Purchase Invoices digitally is a manual, multi-step process:

- Download PDF from ERPNext manually

- Open the document in a third-party tool like Adobe Acrobat, eSigner, or DSC software

- Apply digital signature using USB token or PFX file

- Save and re-upload the signed PDF back into ERPNext

This process is:

- Time-consuming and inefficient

- Prone to human error

- Not auditable or tracked within the ERP system

- Not scalable for organizations with high document volume

✅ Our Solution

This app eliminates that problem by enabling automated and visible digital signatures inside ERPNext:

- One-click digital signing using .pfx file

- Signature placement via coordinate selection

- Signed PDF automatically replaces the original and is attached to the document

- Full signing process is tracked inside ERPNext

What is a PFX File?

A PFX file (also called PKCS#12 file) is a binary file format used to store a certificate (public key) along with its private key and optionally a chain of trusted certificates. It's commonly used to import and export certificates and private keys securely. Full form: Personal Information Exchange Purpose: Securely bundle private key and certificate(s) in one file Use cases: SSL/TLS certificates, code signing, email encryption, and digital signatures.

How to Obtain a PFX File?

- From a Certificate Authority (CA):

When you purchase an SSL certificate or a digital signing certificate, the CA usually provides a .pfx file after you complete the validation process.

Intended usage PFX: Sign transaction, Sign document, Client Authentication, 1.3.6.1.4.1.311.10.3.12, 1.3.6.1.4.1.311.20.2.2, Acrobat Authentic Documents.

🔧 Features

- Digitally sign submitted Sales Order, Sales Invoices, Purchase Order, and Purchase Invoice using your .pfx certificate

- Choose the exact signature position by clicking on a PDF preview

- Automatically attaches the signed PDF to the respective Sales Order, Sales Invoices, Purchase Order, and Purchase Invoice.

- Supports visible signatures on any page

- Secure password input for PFX files

- Intended usage PFX: Sign transaction, Sign document, Client Authentication, 1.3.6.1.4.1.311.10.3.12, 1.3.6.1.4.1.311.20.2.2, Acrobat Authentic Documents etc.

✅ Version Compatibility

| ERPNext Version | Frappe Version | Compatibility |

|---|---|---|

| v14.x | v14.x | ✅ Fully Compatible |

| v15.x | v15.x | ✅ Fully Compatible |

⚙ Setup Instructions

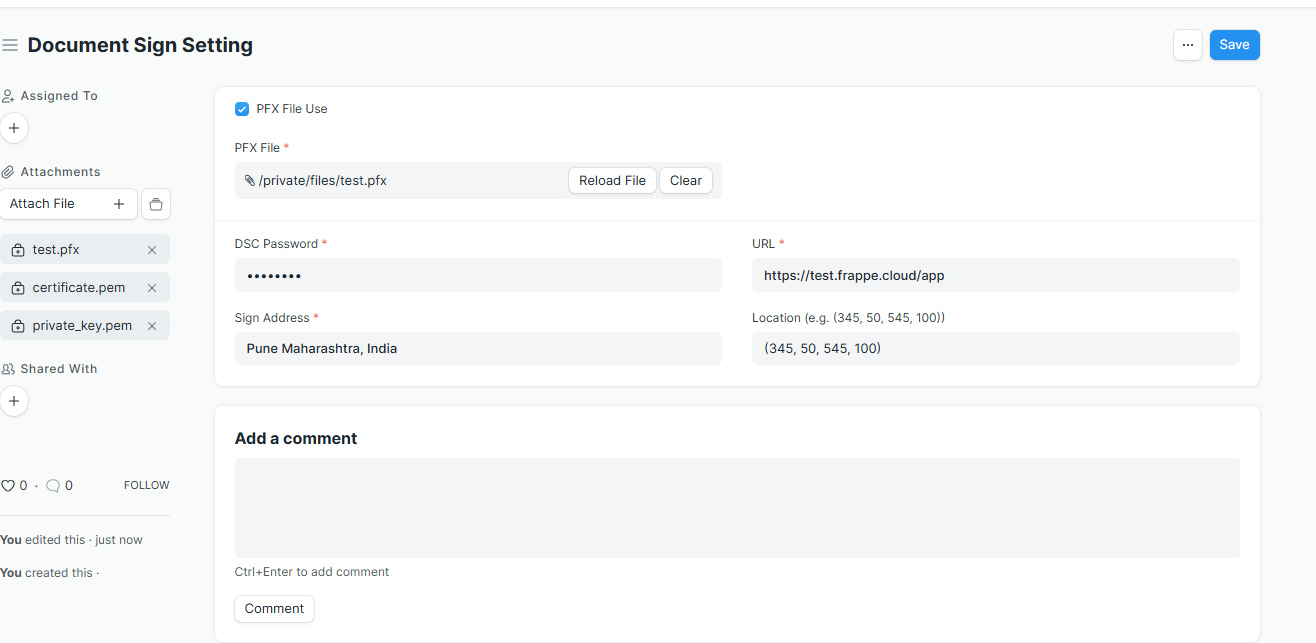

🔧 Document Sign Setting Configuration

To use digital signing, configure the Document Sign Setting in ERPNext:

- Go to "Document Sign Setting" via the awesome bar

- Fill in the following fields:

| Field | Description |

|---|---|

| ✅ PFX File Use | Enable this if you're using a .pfx file for signing |

| PFX File | Upload your .pfx certificate file (stored in private/files/) |

| DSC Password | Password for your .pfx file |

| Sign Address | Your signing location (e.g., Pune Maharashtra, India) |

| URL | The server URL that signs the PDF (e.g., https://your-site.frappe.cloud/app) |

| Location | Coordinates for signature in format (x1, y1, x2, y2) Example: (345, 50, 545, 100) |

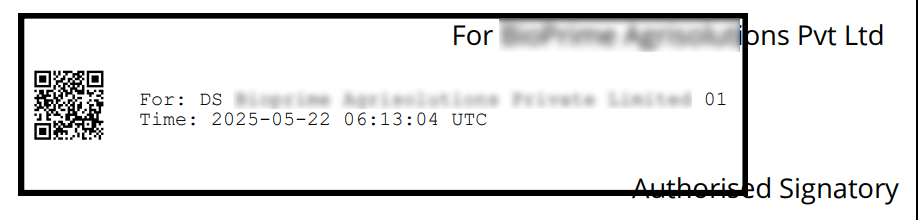

🔍 Signature Placement Preview

Sample Signature on Sales Invoice

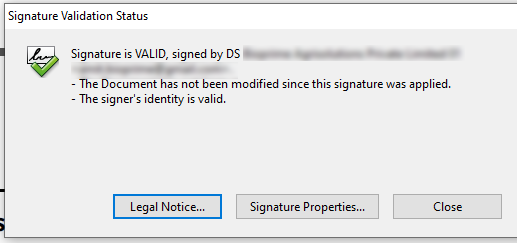

Sample Signature validity on Sales Invoice

Digital Signature: How It Works - Demo

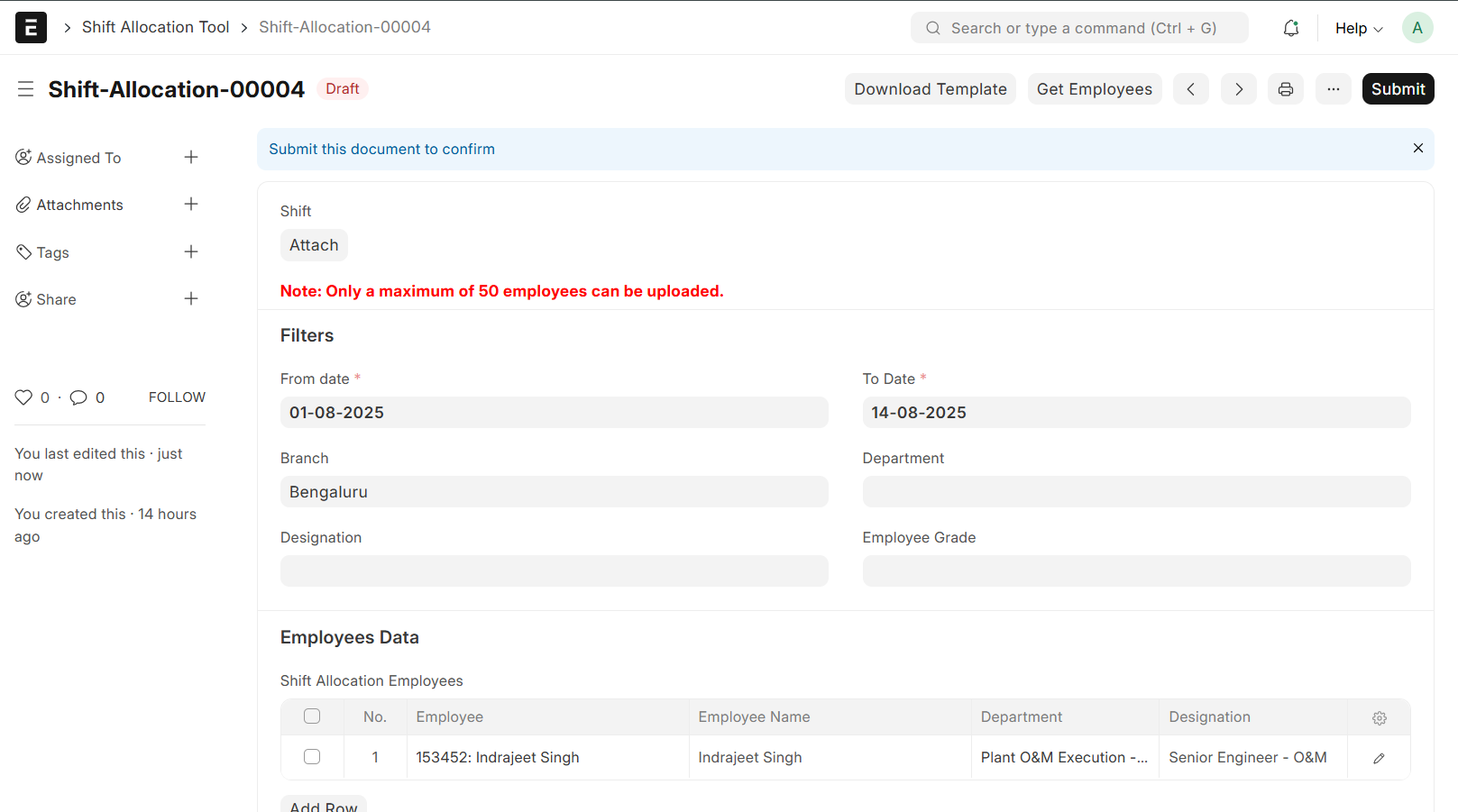

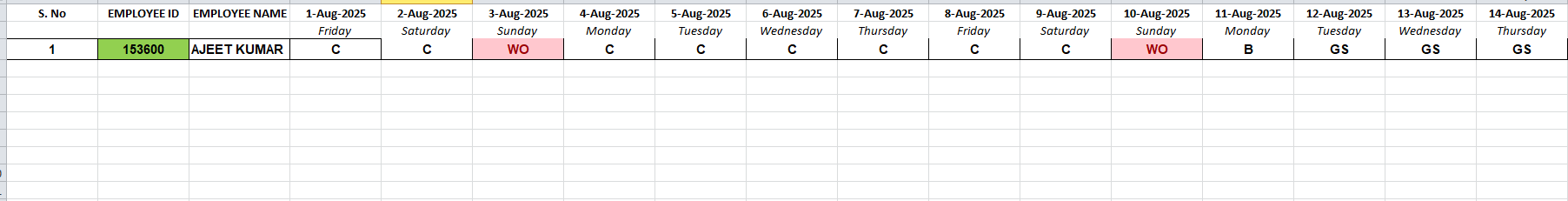

Shift Allocation From Excel

To provide HR managers a convenient way to assign employee shifts in bulk through an Excel template with validations, upload capability, holiday list integration, and employee limits.

⚠ Problem Statement

Managing shift allocations for a large number of employees in ERPNext is time-consuming and error-prone when done manually. HR teams face challenges such as:

- Bulk Assignment Difficulty – No built-in feature to assign shifts to multiple employees across date ranges efficiently.

- Missing Holiday Lists – Errors occur if employees do not have an assigned holiday list, leading to incorrect scheduling.

- Manual Data Entry – Daily shift entries in the system require repetitive manual effort.

- Limited Upload Interface – No user-friendly interface to upload pre-defined shift schedules via Excel.

This process is:

- Time-consuming and inefficient

- Prone to human error

- Not scalable for organizations with high document volume

✅ Our Solution

To address the limitations in ERPNext’s standard shift assignment workflow, we developed a custom Shift Allocation Tool with the following capabilities:

- HR users can download a pre-formatted Excel template with employee and date columns.

- Shifts can be selected from drop-downs per day using data validation.

- Dynamically fetches active employees based on filters (department, designation, etc.). using Get Employee Button

- Supports up to 50 employees per upload to ensure optimal performance.

- All shift assignments are stored with timestamps and can be tracked per employee for audit purposes.

🔧 Features

1. Excel Template Generation Automated

- Dynamic creation based on selected date range

- Includes Employee ID, Name, and daily shift columns

- Drop-downs using data validation for valid shifts

- Weekday names displayed above dates

2. Get Employees Button Interactive

- Fetches active employees with optional filters (Department, Branch, etc.)

- Auto-populates employee list in the tool

- Max 50 employees per batch for performance optimization

3. Excel Upload & Shift Assignment Bulk Upload

- Upload Excel with predefined structure

- Parses shift data per employee and date

- Performs validation before saving

4. Weekly Off & Holiday List Integration Smart

- Checks for missing holiday list per employee

- Adds default weekly offs if required (e.g., Sundays)

- Prevents shift allocation on holiday dates

✅ Version Compatibility

| ERPNext Version | Frappe Version | Compatibility |

|---|---|---|

| v15.x | v15.x | ✅ Fully Compatible |

🔍 Excel Preview

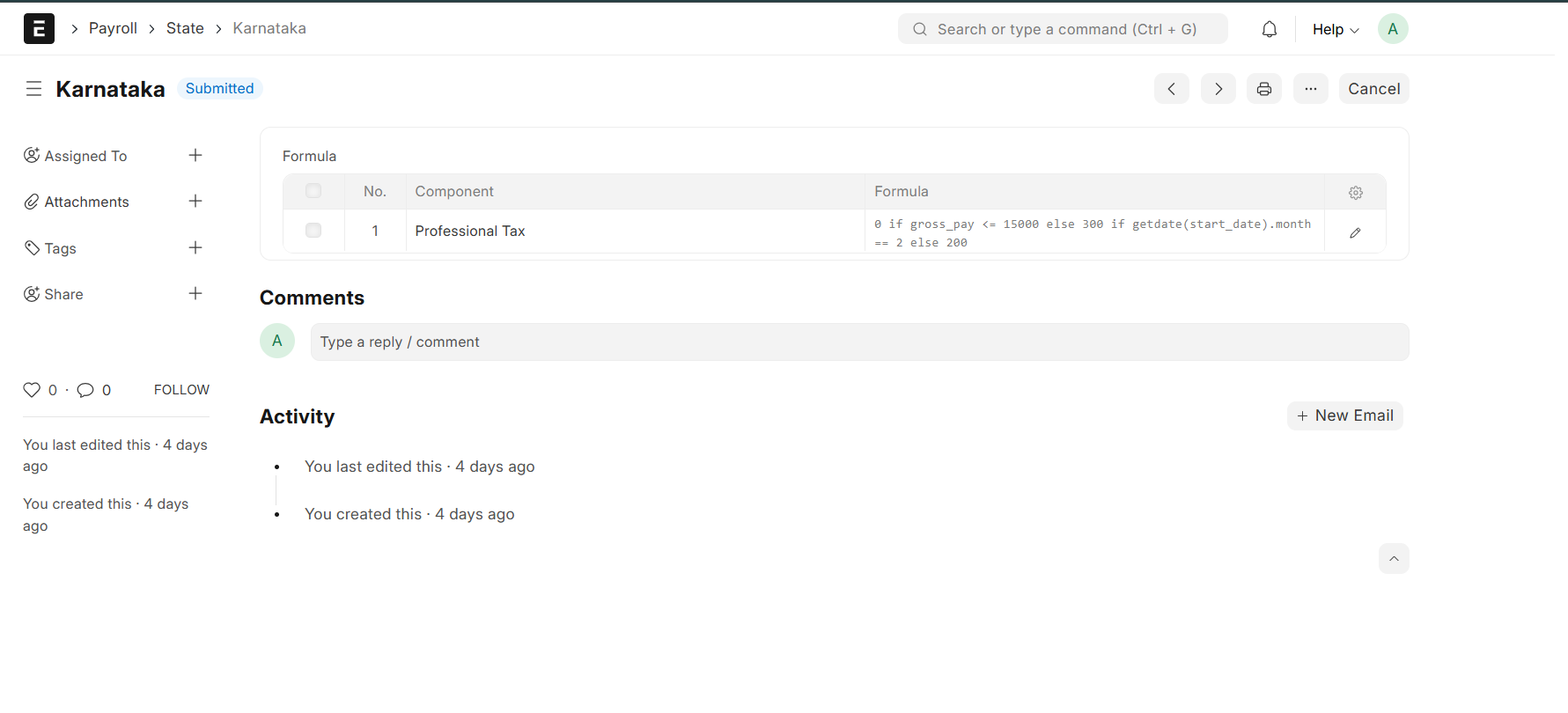

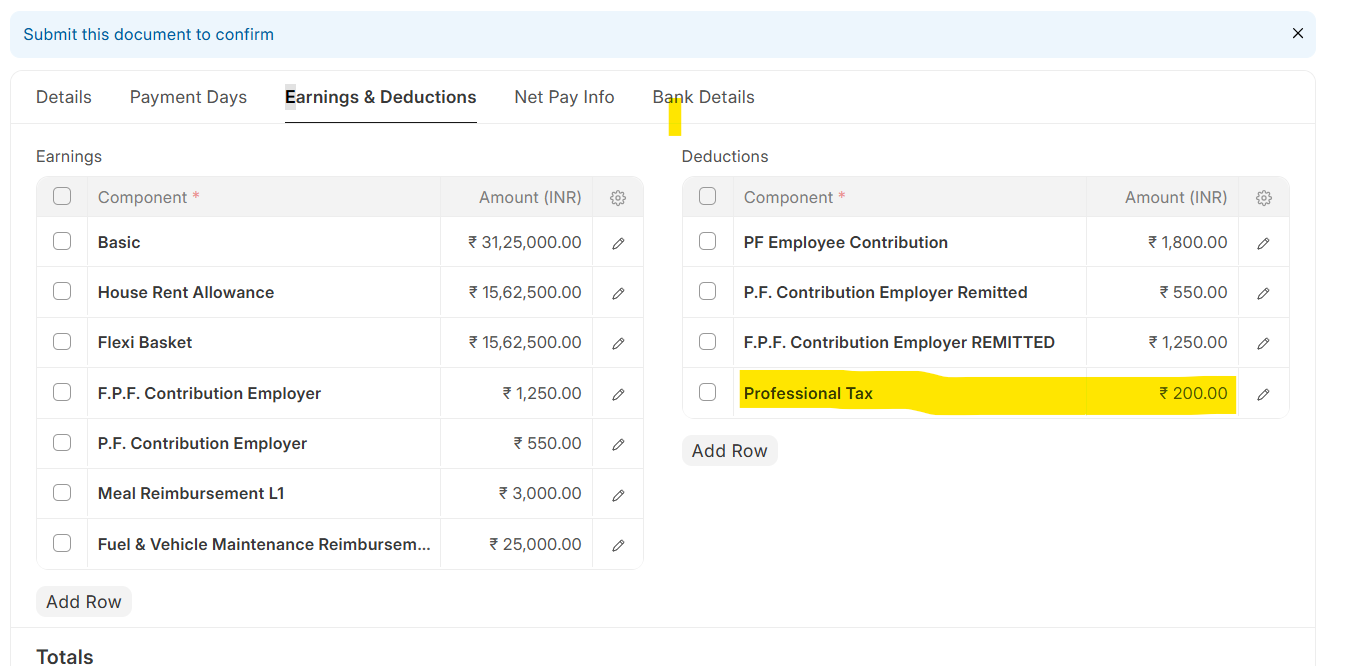

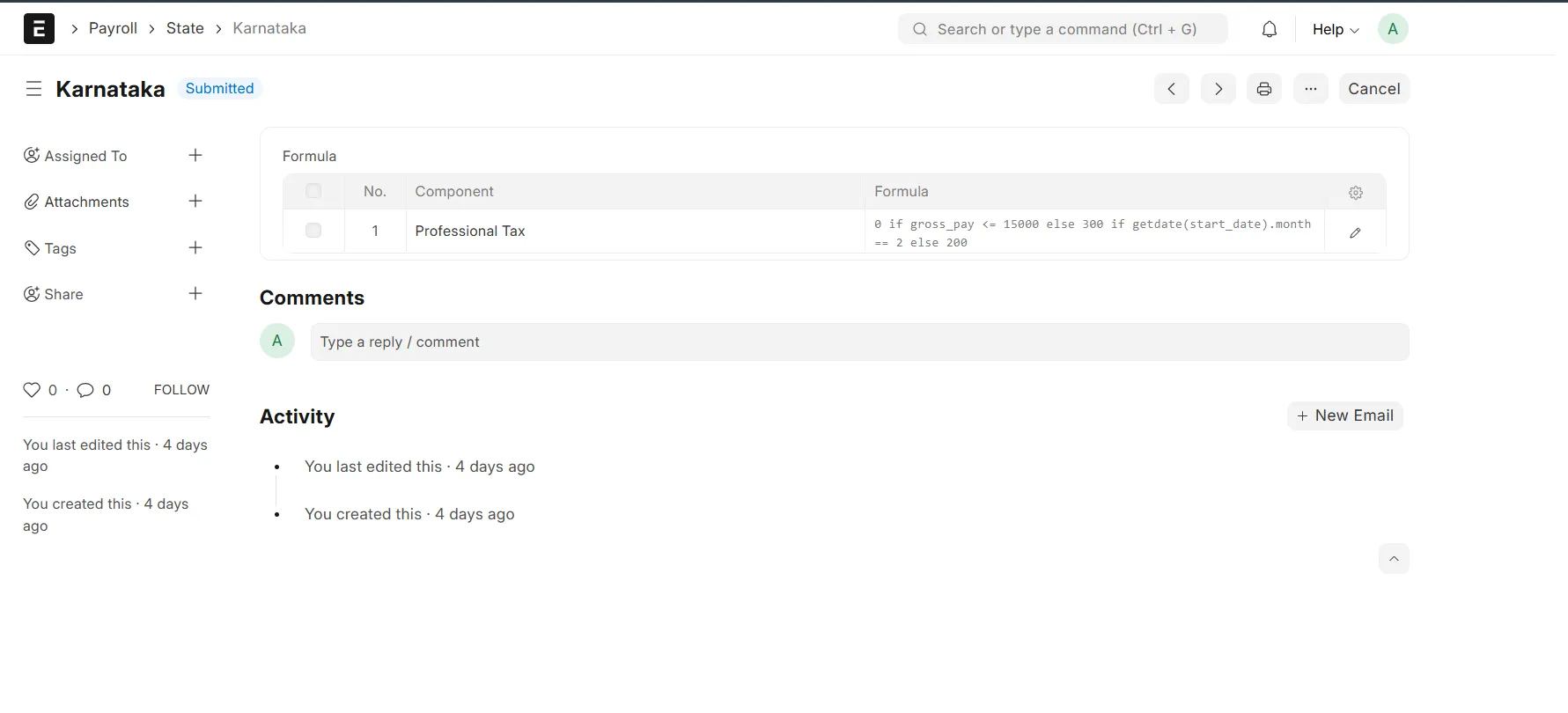

Professional Tax Calculation State Wise

This app enables automated Professional Tax calculation in Salary Slip based on custom formulas defined at the state level.

⚠ Problem Statement

- Manual Setup: ERPNext’s default payroll requires Professional Tax to be added manually in each Salary Structure. There is no built-in calculation logic tied to state-specific rules.

- Error-Prone: Hand-entering tax slabs or amounts is very error-prone. A misplaced figure or outdated slab can lead to incorrect deductions. Even small payroll errors can have significant financial consequences.

- Compliance Risk: Every state has its own PT schedule (e.g., Maharashtra’s monthly slabs), and these rates change periodically. Failing to update a slab table or formula can result in non-compliance and penalties. Keeping multiple rate tables in sync manually is difficult and risky.

- State Variability: ERPNext’s standard payroll does not easily support multiple state-level rules. Out-of-the-box, each state or region would need separate salary structures or custom scripting to account for its PT calculations, making maintenance cumbersome.

✅ Our Solution

- Introduce a custom “State” doctype with a child table to define per-state, slab-based PT formulas.

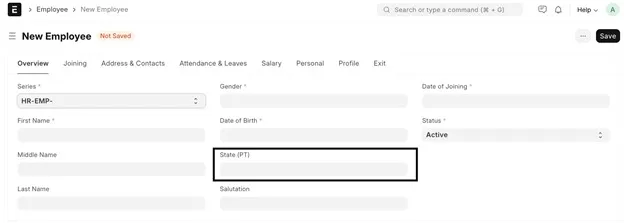

- Add a “State (PT)” link field on Employee so each employee is tied to their state’s formula table.

- On Salary Slip validation, automatically evaluate the appropriate PT formula (using safe_eval) and insert the “Professional Tax” deduction.

- Maintain all PT rules in the ERPNext UI—no code changes needed when state rates change.

🔧 Features

- State-wise PT Configuration: Define dynamic tax slabs per state using Python-style formulas in a custom “State” doctype.

- Employee-State Linking: Automatically associate each employee with their state’s PT rules via a custom State field on the Employee doctype.

- Auto Tax Deduction: On Salary Slip creation (manual or via Payroll Entry), the app calculates and injects the correct “Professional Tax” deduction line.

- Safe Formula Evaluation: Uses Frappe’s safe_eval to securely evaluate any valid slab or conditional expression.

- Fully Configurable from UI: Update or add new PT formulas through the ERPNext interface—no code changes required.

- Standalone & Lightweight: No dependency on India Compliance or other external apps—simply install and configure.

✅ Version Compatibility

| ERPNext Version | Frappe Version | Compatibility |

|---|---|---|

| v14.x | v14.x | ✅ Fully Compatible |

| v15.x | v15.x | ✅ Fully Compatible |

⚙ Setup Instructions

To use Professional Tax, configure the State, Formula Component wise, Employe master have field State in ERPNext:

- Define State & Formula Go to State and create a new record (e.g., “Maharashtra”).

- In the Formula child table, add a row for each PT slab: Component: “Professional Tax”

- Formula:

0 if gross_pay <= 7500 else (175 if gross_pay <= 10000 else (200 if getdate(start_date).month != 2 else 300)) - Submit the State record (only submitted states appear for employees).

- Assign State to Employee Open an Employee record.

- In the State (PT) link field, select a submitted State (e.g., “Maharashtra”).

- Automatic PT Calculation on Salary-Slip via Payroll or Manually.

Sample Salary slip

Sample Employee

Sample State

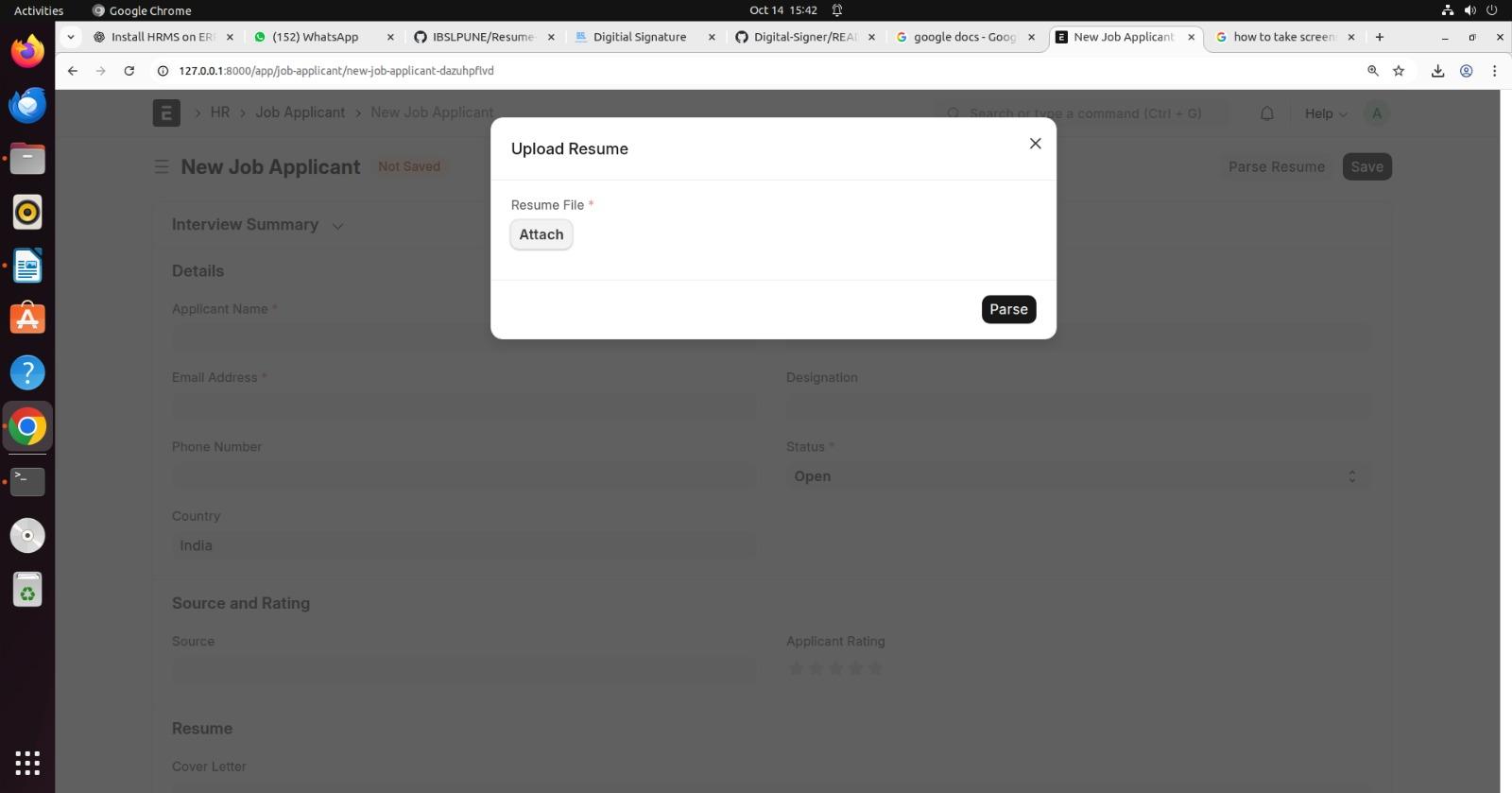

Resume Insights – Resume Parsing

Automatically extract Name, Email, and Phone Number from resumes (PDF/DOCX) and populate ERPNext Job Applicant form.

⚠ Problem Statement

Manual entry of candidate details from resumes is time-consuming, error-prone, and slows down the recruitment process.

- Human error when entering Name, Email, Phone manually

- Time wasted processing multiple resumes

- No integration with ERPNext Job Applicant form

✅ Our Solution

Resume Insights automatically parses uploaded resumes and fills the ERPNext Job Applicant form with extracted details, improving efficiency and accuracy.

- Upload PDF or DOCX resumes directly

- Extract Name, Email, Phone automatically

- Populates Job Applicant form in ERPNext

- Error handling for invalid/unreadable files

🔧 Features

- Supports PDF and DOCX formats

- One-click parsing from Job Applicant form

- Auto-populates Name, Email, Phone fields

- Seamless ERPNext integration

- User-friendly interface for HR teams

✅ Version Compatibility

| ERPNext Version | Frappe Version | Compatibility |

|---|---|---|

| v14.x | v14.x | ✅ Fully Compatible |

| v15.x | v15.x | ✅ Fully Compatible |

⚙ Setup Instructions

- Go to Job Applicant form in ERPNext

- Click “Parse Resume” button

- Upload the resume file (PDF or DOCX)

- The system automatically extracts details and fills the form

.jpeg)

Resume Parsing Demo